34+ Calculate net present value online

The cost of capital is 10. Present Value of an Annuity.

Formation Of Gaseous Peptide Ions From Electrospray Droplets Competition Between The Ion Evaporation Mechanism And Charged Residue Mechanism Analytical Chemistry

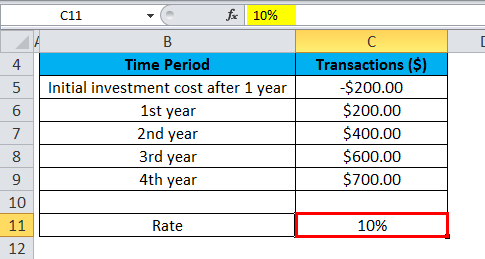

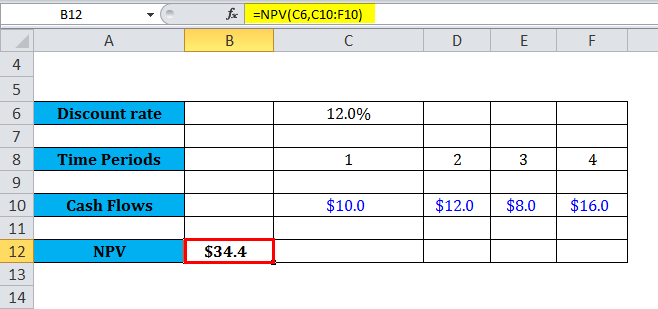

For calculating NPV value using formula you must already know the estimated value of discount rate r all cash flow both positive and negative and the total.

. The Net Asset Value NAV is a business valuation technique under the asset approach experts use to determine the companys fair market value FMV. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at. The NPV calculator considers the expenses revenue and capital costs to determine the worth of an investment or project.

Following are the expected cash inflows of the company. To understand this term better you first need to understand the term present value. In order to calculate NPV we must discount each future cash flow in order to get the present value of each cash flow and then we sum those present values associated with each time.

Where r is the discount rate and t is the number of. 1 The NPV function in Excel is simply NPV and the full formula. P V P M T i 1 1 1 i n 1 i T where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the.

It helps in determining if it is worth pursuing an investment. This online calculator will allow you to calculate the NPV Net Present Value of an investment. Its easiest to calculate NPV with a spreadsheet or calculator.

The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic. The scrap value at the end of 4 year is 72000. The calculation is based on the initial investment and the.

NPV calculation formula. If you wonder how to calculate the Net Present Value NPV by yourself or using an Excel spreadsheet all you need is the formula. The process gets cumbersome if you have numerous cash flows.

If you want to customize the colors size and more to better fit your site then pricing starts at just. NPV is a widely used cash-budgeting method for assessing projects and investments. Register free for online tutoring session to clear your doubts.

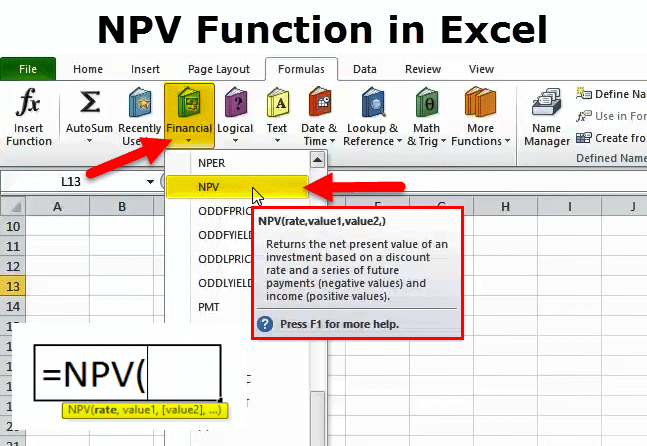

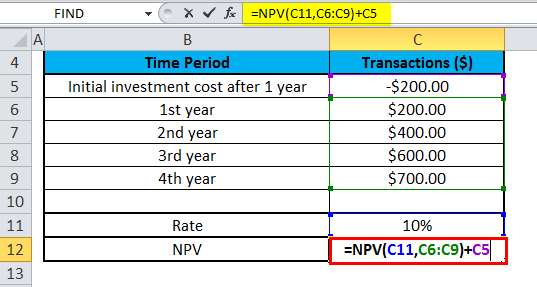

The net present value calculator exactly as you see it above is 100 free for you to use. NPV Cash Flow n 1 Discount Rate n. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow.

34 Cryptocurrency Landing Page Templates By Templatemonster

Financial Decision Making Bsns 114 Notes Bsns 114 Financial Decision Making Otago Thinkswap

Mana Capital Acquisition Corp Form425 Benzinga

The Vantage Blog Caroline County Economic Development

Formation Of Gaseous Peptide Ions From Electrospray Droplets Competition Between The Ion Evaporation Mechanism And Charged Residue Mechanism Analytical Chemistry

Npv In Excel How To Use Npv Function In Excel

.jpg)

Windsor On White Rock Lake Apartments 9191 Garland Road Dallas Tx Rentcafe

The Vantage Blog Caroline County Economic Development

Npv In Excel How To Use Npv Function In Excel

W7z6altvsrmm6m

Development And Validation Of A Risk Prediction Model Of Preterm Birth For Women With Preterm Labour Symptoms The Quids Study A Prospective Cohort Study And Individual Participant Data Meta Analysis Plos Medicine

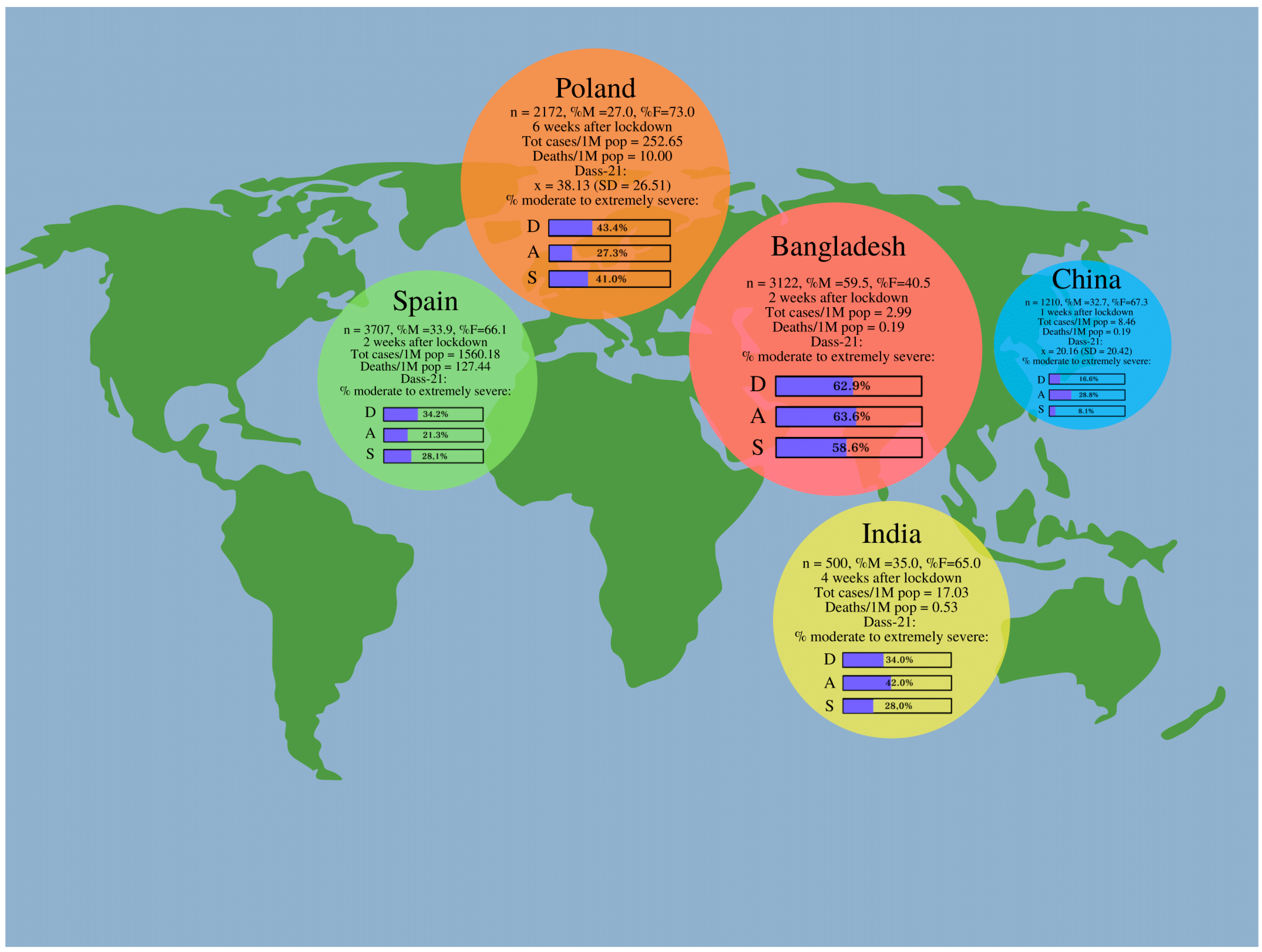

Jcm Free Full Text The Outbreak Of Sars Cov 2 Pandemic And The Well Being Of Polish Students The Risk Factors Of The Emotional Distress During Covid 19 Lockdown Html

2

Which Standardized Test Score Should I Send 34 Act Or 1530 Sat Quora

Npv In Excel How To Use Npv Function In Excel

Npv In Excel How To Use Npv Function In Excel

The Vantage Blog Caroline County Economic Development