Stock volatility calculator

Days are counted starting from the most recent trading day. CME benefits from volatility Thats according to Karen Firestone of Aureus Asset Management who appeared on CNBCs Halftime Report Final Trades.

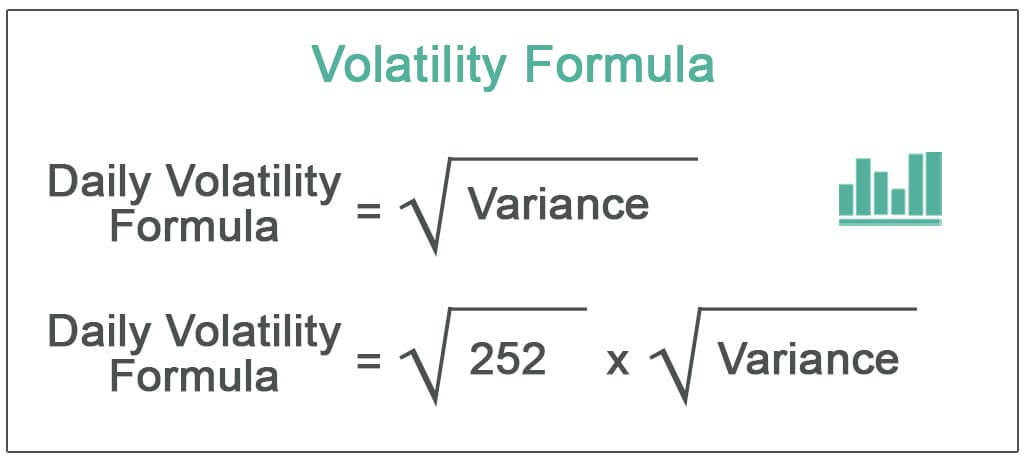

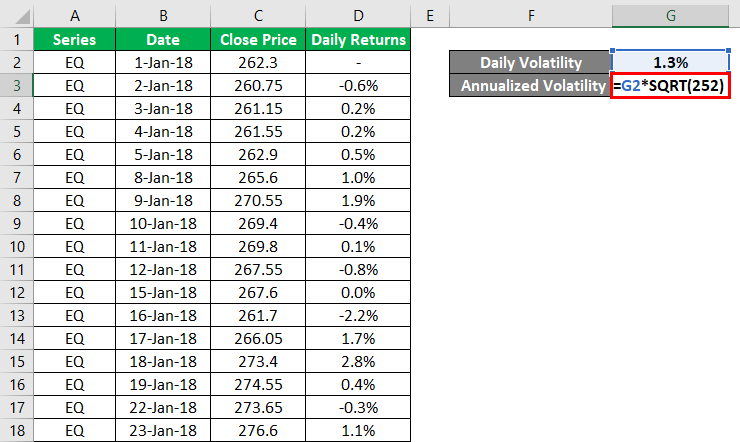

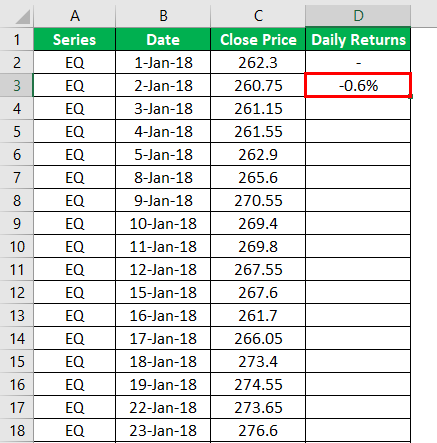

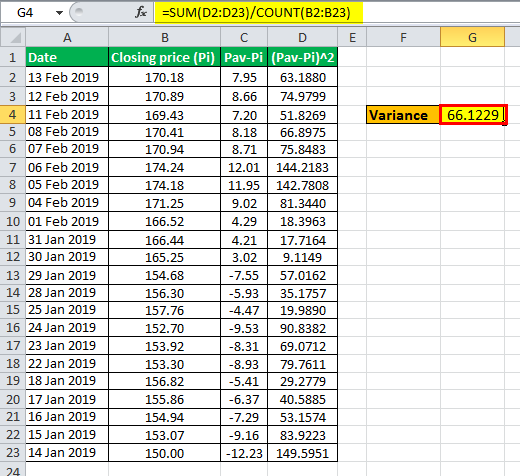

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Stock options restricted stock units and other types of equity compensation are valuable benefits.

. The following calculation can be done to estimate a stocks potential movement in order to then determine strategy. Our Options Calculator calculates fair values and Greeks for any options contract using calculates fair values and Greeks for any options contract using live data. Stock quotes reflect trades reported through Nasdaq only.

Nifty above 17600 Sensex up over 200 points Trading with volatility amid weak global cues the benchmarks turned green as Nifty50 reclaimed 17600 while the Sensex climbed over 200 points. NTM Volatility - Near The Money Volatility is the implied volatility interpolated from current near term near the money option. Price - is the current Stock Price.

How To Stomach Volatility In Your Companys Stock Without Losing Your Mind. When the companys stock price becomes a rollercoaster remember that equity comp is a long-term deal. Stock Market Highlights 24th August 2022.

The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. Issued a letter to shareholders Wednesday saying that volatility in the companys stock price will not affect its business operations. Before deciding to trade you should carefully consider your investment objectives level of experience and risk appetite.

Intro to Modern Portfolio Theory. The home of volatility and corporate bond index futures. Cryptocurrency miner Bit Mining Ltd.

Stock market update. For a more accurate calculation of what implied volatility is saying a stock might do use Ally Invests Probability. You can call it your option strategy calculator.

The theoretical value of an option is affected by a number of factors such as the underlying stock priceindex level strike price volatility interest rate dividend and time to expiry. Stock Turnover Ratio Cost of Goods Sold Average Inventory. Intraday data delayed at least 15 minutes or per exchange.

The recovery was led by Financial and FMCG stocks. For example a 30-day option on stock ABC with a 40 strike price and the stock exactly at 40. CME Group Inc NASDAQ.

This article offers expert advice for coping with stock-price. Trading FX and CFDs on margin carries a high level of risk and may not be suitable for all investorsCMS Prime offers trading on margin. Why index funds are theoretically optimal.

Vega for this option might be 003. How implied volatility can help you estimate potential range of movement on a stock. Implied volatility is expressed as a percentage of the stock price indicating a one standard deviation move over the course of a year.

The benchmarks juggled between gains and losses before closing the day with a gain of 09-015. August began with so much promise for the US. Trading with leverage can work against you as well as for you.

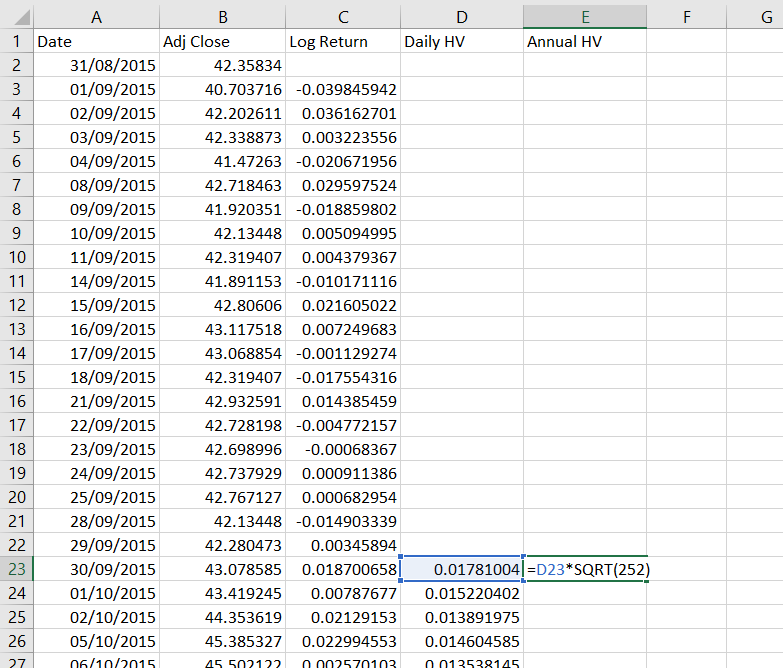

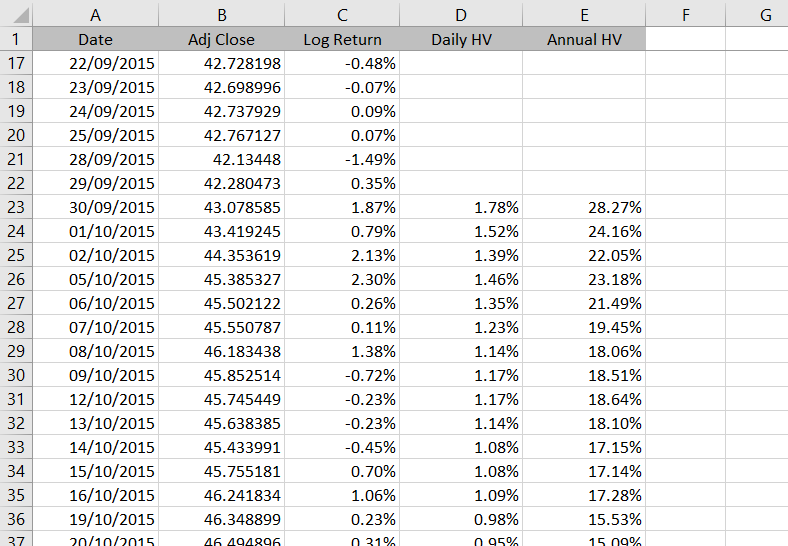

In other words the value of the option might go up 003 if implied volatility increases one point and the value of the option might go down 003 if implied volatility decreases one point. In this example I will be calculating historical volatility for Microsoft stock symbol MSFT using Yahoo Finance data from 31 August 2015 to 26 August 2016. Relevance and Uses of Stock Turnover Ratio Formula.

Days - is the number of days in the future for which the probability will be computed. Stock price x Annualized Implied Volatility x Square Root of days to expiration 365 1 standard deviation. Cboes stock and ETP options are SEC-regulated securities that are cleared by the Options Clearing Corporation and offer market participants flexible tools to manage risk gain exposure and generate income.

Finally the formula for a stock turnover ratio can be derived by dividing the cost of goods sold incurred by the company during the period step 1 by the average inventory held across the period step 2 as shown below. More This calculator can be used to compute the theoretical value of an option or warrant by inputting different variables. 2 days agoAll quotes are in local exchange time.

You can customize all the input parameters option style price of the underlying instrument strike expiration IV interest rate and dividends data. Plan your life with a Monte Carlo calculator. Days can be calculated by selecting an Expiration Date.

But just as investors started to believe the worst of. Understand diversification and the Efficient Frontier find a portfolio with the maximum Sharpe Ratio. In the first 10 days of the month the SP 500 surged 52 to a four-month high.

Investment returns depend on an investors risk tolerance. The volatility of stock prices presents an opportunity to buy low at the net buy price and sell much higher at the desired sale price. By Will Feuer.

Stock Profit Calculator is the best calculator to calculate net profits after the commissions you incur for buying and selling for your return on. In another volatile session the market ended with marginal gains amid weak global cues on Wednesday. Real-time last sale data for US.

Take for example AAPL that is trading at 32362 this morning. If you dont have data want to use Yahoo Finance and dont know how to find and download data from there I have created a detailed tutorial using the same MSFT example.

How To Calculate Historical Volatility In Excel Macroption

What Is Volatility And How To Calculate It Ally

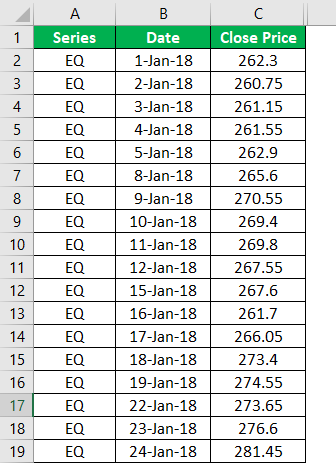

Volatility Calculation Historical Varsity By Zerodha

Calculate Implied Volatility With Vba

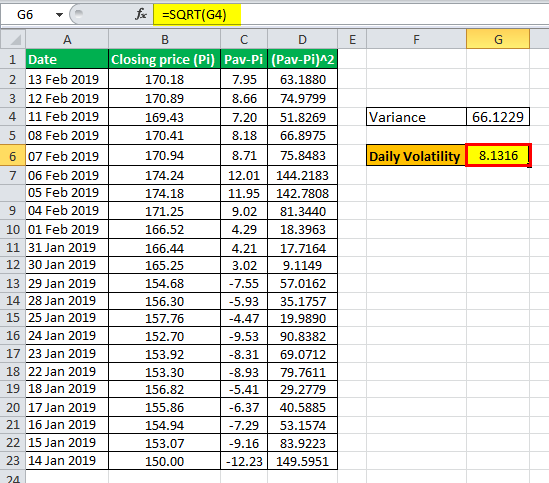

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

How To Calculate Volatility In Excel Finance Train

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

How To Calculate Volatility Using Excel

Volatility Formula Calculator Examples With Excel Template

Volatility Formula Calculator Examples With Excel Template

Price Volatility Definition Calculation Video Lesson Transcript Study Com

How To Calculate Volatility Using Excel

How To Calculate Volatility Using Excel

What Is Volatility Definition Causes Significance In The Market

How To Calculate Historical Volatility In Excel Macroption

Volatility Formula How To Calculate Daily Annualized Volatility In Excel